Forensic Audit Essentials for Law Enforcement and Legal Professionals

In the realm of law enforcement and legal practice, the need for accuracy and integrity in financial examinations has never been more critical. This guide aims to unravel the essentials of forensic audits, providing clarity and understanding on its pivotal role for legal professionals and law enforcement officials.

Understanding the Basics of Forensic Auditing

Forensic auditing involves the examination and evaluation of a firm’s or individual’s financial information for use as evidence in a court of law. This process is not just about going through financial numbers; it involves piecing together the financial puzzle to reveal any abnormalities or evidence of fraud. Forensic audits often begin with a thorough understanding of the financial landscape of the entity under investigation. This includes knowledge of its business operations, control systems, and industry dynamics. Such in-depth understanding allows auditors to identify discrepancies that a standard audit might overlook. Moreover, forensic audits require auditors to carry out their work under the strict demands of potential legal proceedings. Thus, maintaining objectivity and a meticulous attention to detail are key traits within this field.

Utilizing forensic audits can provide clarity in cases where financial discrepancies are suspected but not yet fully substantiated. Auditors employ multiple methodologies like forensic accounting and data analysis to uncover fraud. Understanding these basics is essential for those in law enforcement and the legal profession, as it forms the building blocks of more advanced investigative techniques.

The Role of Forensic Audits in Law Enforcement

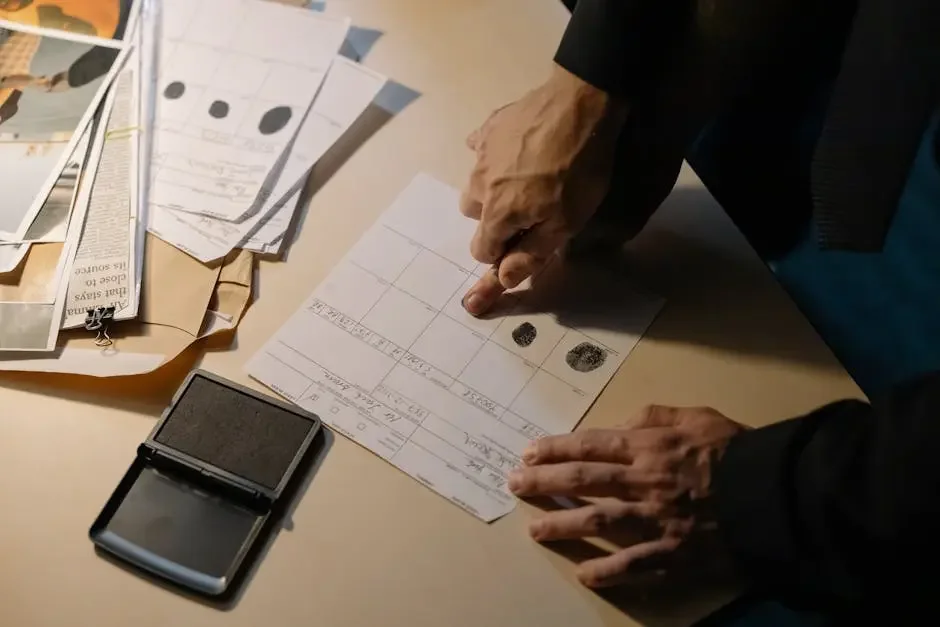

Law enforcement agencies utilize forensic audits to trace illegal financial activities, such as money laundering and embezzlement. These audits help in establishing trails of evidence that can lead to the prosecution of criminals, thus playing a crucial role in fighting financial crime. For instance, in cases involving complex money laundering schemes, forensic audits serve as a powerful tool to follow the money trail across borders and shell companies.

The role of forensic audits extends beyond merely identifying fraud. They are an integral part of criminal investigations, providing insights that are pivotal for prosecuting economic crimes. As financial crimes become more sophisticated, forensic audits evolve to address new challenges, using advanced technologies and methodologies such as predictive analytics and blockchain analysis to stay ahead.

Key Skills for Legal Professionals in Forensic Auditing

For legal professionals, understanding the nuances of forensic audits is vital. Key skills include attention to detail, analytical thinking, and the ability to interpret complex financial data. These skills ensure that the evidence gathered is accurate, reliable, and can withstand scrutiny in a legal setting. A legal professional must be able to distinguish relevant data from irrelevant data efficiently. Furthermore, the ability to prepare and present findings in a clear and convincing manner is crucial for court presentations and hearings.

Another important skill is the aptitude for technology, as modern forensic auditing increasingly relies on specialized software and data analysis tools. Professionals must remain abreast of technological advancements to use tools effectively in investigations. Continuous professional education is recommended, as it helps legal experts refine their skills and stay updated on the latest forensic audit techniques.

Common Techniques and Tools in Forensic Auditing

Forensic auditors use a range of techniques and tools such as data mining software, cross-referencing financial records, and conducting interviews with employees. These techniques are instrumental in identifying inconsistencies and patterns that may indicate fraudulent activity. Data mining, for instance, can detect anomalies in large datasets by uncovering outliers or patterns that suggest illicit activities. By leveraging advanced analytics and machine learning algorithms, auditors automate and enhance the effectiveness of pattern recognition.

Conducting interviews is another technique integral to forensic auditing. Interviews are conducted not just with suspects, but also with key employees who might provide insights into the financial systems in place. Detecting inconsistencies in statements from these interviews can provide valuable leads.

Collaborative Efforts and Challenges

Collaboration between forensic auditors, legal professionals, and law enforcement is crucial for the success of forensic investigations. However, these efforts often face challenges such as data privacy issues, the complexity of financial transactions, and the need for interdisciplinary knowledge. Effective collaboration necessitates clear communication and an understanding of each party's strengths.

One of the most pressing challenges is navigating the legal and regulatory frameworks that govern privacy and data sharing. It’s essential to stay informed of these regulations to ensure compliance. Embracing a teamwork culture that acknowledges these hurdles and works towards innovative solutions is vital for overcoming them.

Case Studies: Learning from Real-Life Forensic Audits

Exploring real-life case studies can provide invaluable insights into the effectiveness of forensic audits. By analyzing past cases, legal professionals can learn best practices and avoid common pitfalls in their own forensic investigations. Case studies from prominent financial fraud cases reveal how forensic techniques were instrumental in unravelling complex fraud schemes.

Studying these examples not only enriches a professional’s understanding of forensic audits but also showcases the dynamic nature of financial crimes. It highlights innovative strategies and tools employed to crack each case and serves as a practical learning experience for ongoing training.

Conclusion: Mastering Forensic Audits in Legal and Law Enforcement

Forensic audits serve as an indispensable tool in the legal and law enforcement arenas, uncovering the intricacies of financial irregularities with precision. By grasping the essentials outlined, professionals in these fields can enhance their investigative capabilities, ensuring justice is efficiently and accurately served. To leverage these skills further, professionals are encouraged to explore comprehensive resources available on our homepage.